Having access and control of your accounts is important, for more information on how to access your account, click on items below.

Online Banking

Manage your accounts electronically without ever entering the branch!

With Online Banking you can:

- View current balances, including detailed histories

- Download transaction history into personal financial software

- Transfer funds between accounts, including setting up automatic transfers

- Request check withdrawals and stop payments

- View cleared checks

- Communicate with CCU via secure e-mail

- View monthly statements

- Utilize the Bill Payer program

- Set up Alerts

Online Banking is a secure way to access your account electronically. To set up Online Banking click register on the Online Banking Login above and follow the steps. You will need to know your savings account number and have a valid email address associated with your account to complete the process.

Once you set up your Online Banking you can also enroll in Bill Payer. Our Bill Payer service is offered as a free service to our members.

- Allows you to schedule payments

- Allows you to pay bills automatically, when you’d like and how much you’d like

- Allows you to schedule up to a year’s worth of payments in advance

- Allows you to review a full payment history at any time you choose

- Allows you to make changes to payments whenever you need to

- You can access Bill Payer anytime of the day or night through Online Banking

To view an interactive tutorial demo of our Bill Payer Service, please click here.

To try our Bill Payer Service through a test interactive demo, please click here.

Mobile Banking

Easy-to-use mobile access to your credit union accounts! The credit union service you expect 24-7!

With CCU's Mobile Banking, you can:

- View current balances, including detailed histories

- Transfer funds between share accounts

- Deposit checks through our Mobile Deposit feature

- Communicate with CCU via secure e-mail

- Find branches and ATMs

- Access and utilize our Bill Payer program

Requirements for Mobile Banking

- Mobile device must have web access

- Must be enrolled in Community Credit Union's Online Banking

- Must have a current email on file to receive one-time PIN

Ready to go Mobile with CCU, Download Our App:

ATM

Take advantage of Surcharge Free ATMs wherever you are!

Plus, you can perform a balance inquiry within seconds to determine the balance in your account. (Remember, the balance will not reflect checks that are outstanding and may not reflect deposits made to your account the day of your inquiry).

SURF is a surcharge-free alliance of select Maine Credit Unions formed to help increase member access to surcharge-free ATMs. CCU is part of the SURF Alliance, meaning that members using their ATM/Visa Debit Card that bears the SURF logo will enjoy a surcharge-free transaction. Just how large is the SURF network? Various Maine Credit Unions represent more than 260 ATMs that are part of this surcharge-free alliance. To find the closest SURF ATM near you, click here.

LA Connection

Free access to your account by the touch of your phone!

- Make account inquiries

- Transfer funds from one account to another

- Make withdrawals from your share or share draft account (check will be mailed to you)

- Schedule a funds transfer

- Check interest rates

- Review loan history

Not already signed up for L.A. Connection?

Call the L.A. Connection phone number above and set up your account today over the phone or stop into a branch and ask a Financial Service Representative for assistance.Menu Shortcuts:

| Main Menu | |

|---|---|

| Press 1 | Account Balance |

| Press 2 | Account History |

| Press 3 | Funds Transfer Activities |

| Press 4 | Share or Loan Withdrawal |

| Press 5 | Interest Rates |

| Press 6 | Account Management |

| Menu 1 (Account Balance) | |

| Press 1 | Savings Account |

| Press 2 | Checking Account |

| Press 3 | Share Certificates/IRA |

| Press 4 | Loan Amount |

| Press 5 | Credit Card |

| Menu 2 (Account History) | |

| Press 1 | Savings Account |

| Press 2 | Checking Account |

| Press 3 | Share Certificates/IRA |

| Press 4 | Loan Amount |

| Savings History | |

| Press 1 | All Transactions |

| Press 2 | Last 5 Transactions |

| Press 3 | Withdrawals |

| Press 4 | Deposits |

| Press 5 | ATM Transactions |

| Press 6 | Amount |

| Press 7 | Date |

| Checking History | |

| Press 1 | All Transactions |

| Press 2 | Last 5 Transactions |

| Press 3 | Withdrawals |

| Press 4 | Deposits |

| Press 5 | ATM Transactions |

| Press 6 | Check Number |

| Press 7 | Amount |

| Press 8 | Date |

| Loan History | |

| Press 1 | All Transactions |

| Press 2 | Last 5 Transactions |

| Press 3 | Payments |

| Press 4 | Advances |

| Press 5 | Amount |

| Press 6 | Date |

| Menu 3 (Funds Transfer Menu) | |

| Press 1 | Transfer Funds Immediately |

| Press 2 | Schedule a Funds Transfer |

| Press 3 | Payments |

| Press 4 | Hear Existing Scheduled Transfers |

| Press 5 | Delete an Existing Transfer |

| Menu 4 (Share or Loan Withdrawal) | |

| Press 1 | Savings Account |

| Press 2 | Checking Account |

| Menu 5 (Interest Rate) | |

| Press 1 | Savings Account |

| Menu 6 (Account Management Menu) | |

| Press 1 | Change PIN |

| Press 2 | Future Dated Transactions |

| Help (at any time during your call you can do the following): | |

| Press (1*) | For Help |

| Press (2*) | Main Menu |

| Press (#) | Repeat the Menu Options |

| Press (*) | Hear the Previous Menu |

| Press (8*) | To Use Voice Recognition |

| Press (9*) | Change Account Number |

P2P / Cash Apps

Worrying about paying bills is not a good use of your time. Community Credit Union has a solution for you.

Peer-To-Peer (P2P) payment options continue to transform as technology becomes more readily available to consumers. Millions of users now use mobile payments. There are many free, fast and safe apps available to use. Please always review the security of the applications you are linking to your accounts.

Common P2P Apps include:- Venmo

- PayPal

- Google Pay

- Apple Pay Cash

- Cash App

When using P2P please keep these limitations in mind:

Money Transmitter (MT) Funding Limits:

If the P2P apps above with per transaction, per day and per week restrictions do not satisfy your payment needs, our Credit Union offers other free services that could assist you. For example, if you use Online Banking you can make transfers to other Credit Union member accounts.

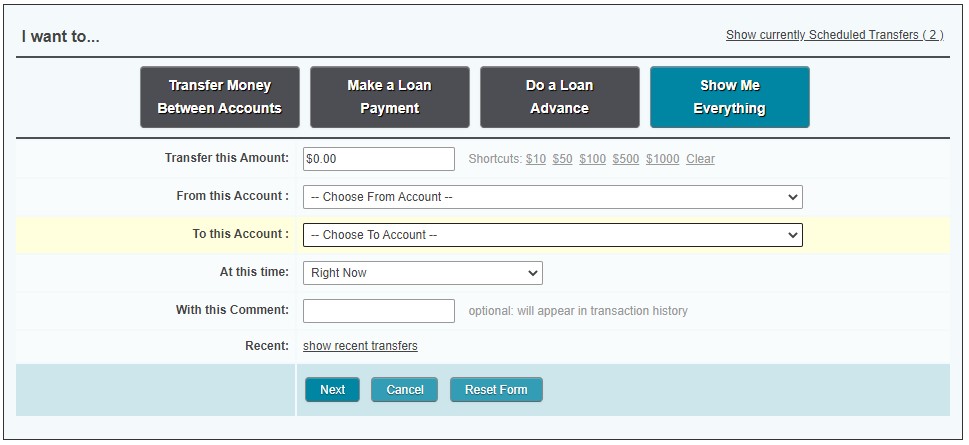

If you are transferring money to another Credit Union member you can go to the Transfer menu in Online Banking and this screen will appear.

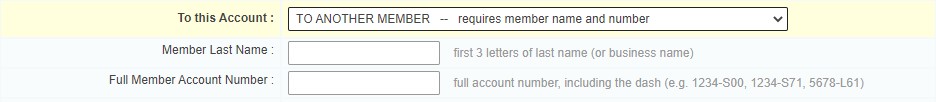

In the ‘To This Account’ drop down select ‘To Another Member’. This will prompt the following additional information fields to be completed in order to transfer. The only restrictions on this transfer method is the balance in the account you are moving funds from.

Community Credit Union also offers Bill Payer which includes an option for Peer-To-Peer (P2P) payments when you enter a specific payee

P2P within Bill Payer has the following restrictions:

If you require a debit card P2P transaction outside of these limits and are not able to utilize online banking / bill pay options, please reach out to Card Services 207-783-2096 option 1.

eAlerts

Alerts allows you to select certain transactions or events taking place in your account that you want to be notified of.

eStatements

Access your statements electronically!

Log into Online Banking and select the eStatements tab to see your most recent statements. With eStatements, you can:

- Access your monthly and quarterly share/share draft statements faster, from wherever you choose - at home, at work or when traveling

- Have no extra fees or costs

- Be assured that your statement is a secured document. Your emailed statement will require you to log into Online Banking to gain access

- Review your previous statements

- Save your statement as a PDF or print it using your own printer

- Have quick access to other credit union services via links provided by your credit union

- View newsletters, inserts or other communications within your statement

Mobile Deposit

A great tool accessed through Mobile Banking app that allows you to deposit your checks electronically!

Just follow these simple steps to deposit checks whenever and wherever you wish.

- Log into Mobile Banking

- Click Mobile Deposit

- Choose the account you wish to deposit the check into

- Enter the amount of the check

- Endorse the back of your check with "for Mobile Deposit Only", also include your account #, date and signature

- Select "Tap here to take a picture of the front of the check", then select "Tap here to take a picture of the back of the check"

- Review your deposit and tap the "submit" button to deposit the check

Shared Branching

Whether you are at work, at home or at your favorite travel destination, Community Credit Union is always nearby.

With Shared Branching, credit unions from all over the country share facilities to give members thousands of convenient locations to perform transactions just as if they were in their home credit union. Whether you are at work, at home or at your favorite travel destination, Community Credit Union is always nearby.

Anywhere you see the Co-op Shared Branch logo, you can conduct a range of transactions* including:

- Deposits

- Withdrawals

- Loan Payments

- Purchase Money Orders, Travelers Checks, etc.

- Much More

To take advantage of this service, when you enter a Shared Branching location, you will need:

- Your Home Credit Union's Name

- Your Share Account Number

- Valid Photo ID

- Address Information

Shared Branching Locator App Available on iPhone or Android

A Shared Branching Locator App is available for download on iTunes or Google Play, search for "Credit Union Shared Branch" or "Credit Union Shared Branching". There is no fee to download. In addition to providing locations, the feature also provides their respective addresses, contact information, hours of operation as well as driving directions directly to the location of the user's choice. Click on the link below to download the Shared Branching App:

Visa ATM/Debit Card

A card that’s more convenient than cash or checks. Shop with yours today!

Our Visa Debit Cards are enabled with EMV technology, also known as chip cards. Chip card transactions offer you advanced security in-store and at the ATM by making every transaction unique. It also makes your card more difficult to counterfeit or copy. If the card data and the one-time code are stolen, the information cannot be used to create counterfeit cards and commit fraud.

Change Your PIN Via Telephone

Your Visa ATM/Debit Card PIN (Personal Identification Number) is what protects the use of your card. The PIN should be kept confidential and not shared with others. Are you looking to change your pin on your Visa ATM/Debit Card? Dial 800-992-3808 from the phone number associated with your account. You will be prompted to enter the following information before setting your PIN:- Visa ATM/Debit Card Number

- CVV Code (3 digit security code on the back of your Visa ATM/Debit Card)

- Last four digits of the cardholder's SSN

Notify Us When You Will Be Traveling

If you are planning to travel away from home, it’s always a good idea to contact Community Credit Union to make us aware of where you will be traveling. This will help to eliminate any problems you may experience with your Visa Debit Card.- Advance notice will help ensure that legitimate purchases are approved. In addition, you will want to verify your daily spending and cash withdrawal restrictions to make sure they are appropriate

- Not all countries are accepted through our network; it is best to call the credit union to verify if you must sign a Block Country Waiver Form prior to traveling

- Memorize your Visa ATM/Debit Card Personal Identification Number (PIN), for security purposes. Never write your PIN on your Visa card

- Keep your Visa ATM/Debit Card account number and the lost/stolen customer service contact number in a safe place (separate from your wallet or handbag)

Is your card lost or stolen?

- Don't panic, retrace your steps to where you last used it. If after business hours report your lost Visa ATM/Debit Card immediately to 800-472-3272 or your lost Visa Credit Card to 800-991-4961

- Review your recent charges on the card with a Card Services Representative to see if they were fraudulent or not

- Replace card per Payment Services recommendation (a replacement card fee may be assessed)

Visa Travel/Gift Card

A great alternative to carrying cash!

Visa Gift Cards are great for the hard-to-buy for person on your shopping list.

They are offered in increments of $25.00 to $1,000.00. There is a $4.95 activation fee per card. It’s also a safe alternative to carrying cash while on vacation, however Visa Gift Cards are no longer accepted outside of the United States so if traveling out of the USA please purchase a Visa TravelMoney® Card.Visa TravelMoney® — the card that goes almost anywhere.

It’s easier to use than travelers cheques and safer than cash.Enjoy these great benefits:

- Use it at millions of locations worldwide wherever Visa is accepted

- 24-hour ATM access for cash in local currencies at favorable exchange rates

- Fast and easy replacement of lost or stolen cards and cash

Wire Transfers

We can assist in sending domestic/international wire transfers to other institutions across town, across the state and/or across the country.